Transfer Pricing & Benchmarking

Transfer pricing refers to the rules governing the pricing of transactions between entities within the same local or multinational group. For example, if a UAE subsidiary sells products to its foreign parent company, the sale price must follow the arm’s length principle, reflecting the terms that independent parties would agree upon under market conditions.Under the UAE corporate tax, the Federal Tax Authority (FTA) requires businesses to apply transfer pricing rules to prevent profit shifting, under-reporting, and aggressive tax planning.

Benchmarking Analysis in Transfer Pricing

Benchmarking analysis serves as the foundation of transfer pricing compliance in the UAE. It involves comparing related-party transaction prices with independent market data to ensure that transactions meet the arm’s length standard:

For instance:

- If your company is paying royalties on intellectual property, benchmarking indicates whether the rate compares with industry practice.

- Where a subsidiary provides management services to another group entity, benchmarking justifies the service fee.

- Where intercompany lending is involved, benchmarking ensures that the interest charged is in accordance with market interest rates.

What Are the Key Transfer Pricing Requirements Under UAE Corporate Tax?

The FTA has aligned the UAE transfer pricing rules with international OECD guidelines. Businesses are required to ensure compliance with the following requirements:

Arm's Length Principle – All the related-party transactions must be valued as though executed between independent parties.

Documentation – Depending on revenue, firms might be required to document transfer pricing (Master File and Local File).

Disclosure Forms – Firms are obligated to disclose related-party transactions in the corporate tax return annually.

Benchmarking Analysis –An Extensive study to determine compliance with the arm's length principle.

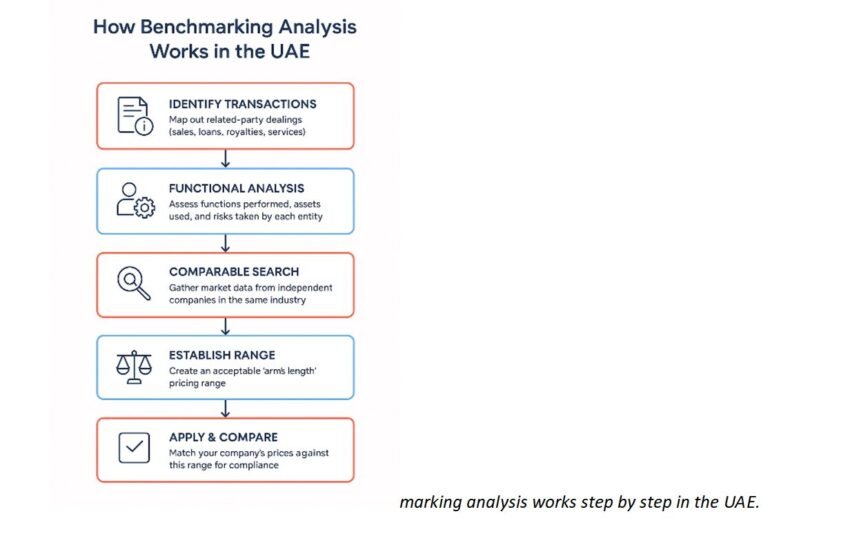

How Does Benchmarking Analysis Work?

Benchmarking is a process with both technical and access to market databases requirements. This is how it commonly occurs:

- Transaction Identification – The intercompany transactions are first detailed out (sales, services, loans, royalties, etc.).

- Functional Analysis – The role, risk, and assets of each entity are analyzed.

- Similar Search – Independent market data are accessed from databases to identify similar companies or transactions.

- Range Establishment – A range of acceptable prices is derived based on the data.

- Application – The firm's own prices are compared to this range to ensure compliance.

To make the process easier to understand, here’s a simple flowchart that shows how bench

Effects of Noncompliance with Transfer Pricing Rules in the UAE

Effects of noncompliance with UAE transfer pricing rules include:

Tax Adjustments – The FTA can revalue your related-party transactions, which will increase your taxable income.

Financial Penalties –Noncompliance can result in significant fines

Reputation Risks – Non-compliance can damage investor confidence and cross-border business relationships.

Seek the Expert Services of Corporate Tax Consultants in the UAE

To seamlessly ensure compliance with the UAE Transfer Pricing requirements and regulations, businesses are advised to seek the expert services of top Tax Consultants in the UAE. Contact us today, and we shall be glad to assist you.

How Professional Help Will Help

Top corporate tax consultants in the UAE can assist with the following:

- Preparation of transfer pricing policies and documentation.

- Conducting benchmarking analysis tailored to your industry.

- Supporting FTA audits and responding to questions.

- Tax-compliant but efficient intercompany structures.